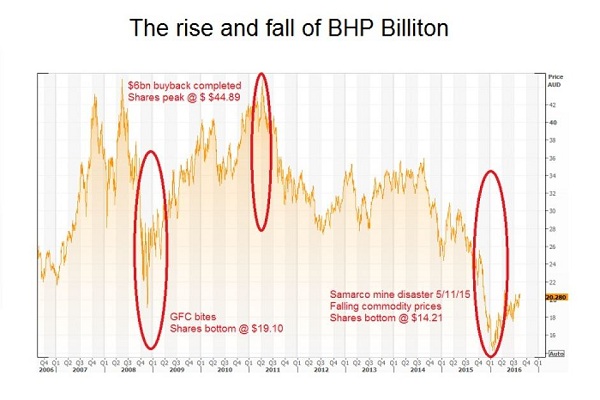

I want to comment on this article profitability of the shares having a peak in its price. I’ll pretend to do buying shares whose daily minimum contribution is far from closed. Or what is the same, that under the body of your candle with a long tail or peak.

The fact that an action has come to fall much and yet has recovered on the same day, is a bullish sign, because in a moment of doubt buyers have ended up imposing clearly sellers.

So we buy that action, opening the next day. And we sell very fast, three days after the close.

This is obviously not a long-term system. We talk fast trading.

More details: how long should be the peak to consider buying? Well, we will trim: Very long. Longer than the larger body of the candle (either white or black) that occurred in the last 5 sessions. Thus, we adapt to the volatility of the value at the time: if you have large candles, will require a large peak. If your candles are lately smaller, we will require a smaller peak.

And that’s it. Although the image of candles can suggest, we will not require that the action has fallen lately. Although recent days has been flat or bullish, if you make a large peak, we bought it.

To test the system, we will buy up to 3 simultaneous actions SP500, between 2007 and 2013, applying standard commissions IB and zero slip. Their results are:

System results peaks 1

- Earn 22% per year, which is not bad, but their worst losing streak is 51%.

- Too much loss. We must reduce risk.

- But if we look at the results segmented by year:

- We see that the bearish years makes it quite bad, but not so bullish.

- So we filter algorithm to operate only in bullish times.

There are many ways to define a bullish momentum. I often use the Golden Cross , which is the crossing of the moving average of 50 sessions with 200 sessions of the general index SP500. In the long run, when the MM50 is higher than the MM200, the stock market rises.

Thus, the results with this filter are:

System results peaks 2

The annual result is maintained, but the maximum DD drops to 33%.

And the RAR ( Risk Adjusted Return ), which measures the profitability invested only in moments, is no less than 34%.

It is a major improvement; however, the draw down it is still a little high. How to download it ?. Apply a different filter: instead of operating in bullish times, we operate in times of low volatility. To do this, we will use the ATR indicator as a filter on the overall index SP500: Above 16, we consider the time too volatile and therefore not operate.

System results peaks 3

The annual result low 7 points, but the worst DD low 11 points, thus being more tolerable risk. It is more prudent than the previous system.

Therefore, people with higher risk tolerance might use the filter Golden Cross , which reaches 22% profit, and the more conservative, the volatility. Or alternate them depending on the accrued benefits.

In any case, these statistics are promising, but not enough to exploit the system in practice. That is, the results allow us to see that stocks with spikes or long lines tend to be profitable, but do not recommend using this system as it is, because it is too simple.

I want to show only a signal to add to our technical arsenal, as complementary to other indicator that we can have.

For example, if we buy a stock that is clearly bullish, but we expect a pullback to enter, if we see a sharp spike in the price of a day it may be time to jump on the bandwagon, coming just before a slight rebound.

Or, if we are watching the typical value that is on everyone’s lips, analyzing all the time in the press and forums, a long beak on your candle quote may be a signal to enter, with short-placista mood, leaving after 2 or 3 days with benefit.

This peak seems very simple, and it is, but it is something commonly used by many professionals. Although it should be complementary to other signs, it is a first-rate technical indicator that can help us a lot to make money in the markets.

But always with prudence ..