How do I know where to invest my money, what will be the next successful technology? Because with a periodicity, appears in economy a new concept, a new industry or technology that carries out a spectacular ride in the stock market.

There are many examples, at various levels: The best known was the .com bubble, which in fact included broad technological sectors, in what at the end of the 90s called the “new economy“: indefinite growth without inflation.

This is the weekly chart of the well-known manufacturer of Cisco routers:

CSCO

In the year 95 CSCO was sold for 2 dollars. At the beginning of the year 2,000, to about 70. If we had put some savings of 6,000 euros in year 95, in 2,000 would have been 210,000 euros.

Of course the difficulty is in knowing how to sell at highs, since from that year CSCO collapsed. Yet the potential benefits of a sector that begins to take off like a rocket is evident.

Another classic example is Apple. In 2007 he announced the iPhone, which delved into its successful technology strategy that began with the iPod. This is your weekly chart:

Apple

In 2007 Apple was trading at $ 86. Currently it is over 650.

Therefore, the question is how to detect a sector or a value that is going to take off in a sustained way in the coming years.

A very interesting proposal is the “additive manufacturing“.

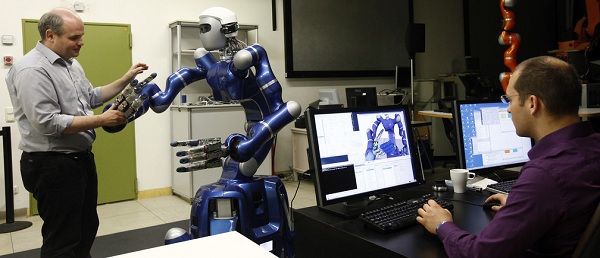

This “additive manufacturing”, also sometimes called ” 3D printing ” is using a software – controlled manufacturing, adding layers of material along the lines scanned by the software, to build a part or product of any type machines:

The 3rd industrial revolution.

The first industrial revolution began in Britain in the eighteenth century; The second began in the United States in the 20th century with assembly lines.

Now comes the third.

This system will economically create parts or appliances; ie it will get to enter the customization in industrial processes. The quality will be maximum and the minimum cost.

The economic production of products, which is now only achieved with economies of scale, will be possible at much lower scales.

Much less personnel will be needed, as was the case with the textile machines of the eighteenth century. But the good news is that many Western industries could relocate from cheap labor countries and return to our countries.

The “Economist” magazine says these technologies in this link .

As an example, these are two of the companies that have strong relationship with this technology: Stratsys ( SSYS ) and 3D System Corp ( DDD ).

As you can see in your graphs Yahoo, both have recently tripled its value.

Of course in 2014 they are correcting strongly from the aturas.

But l a strategy with this type of industry is not trading. The strategy should be a long-term investment, introducing capital into the pullbacks (as it happens in 2014) in a progressive way, waiting for the industry to take off with force.

It can be a wait of years, because this industry is in its infancy, and since a lot of attention, is suffering the rigors of

excessive speculation.

This is how the beginnings of all industries are. But in a long-term perspective we could win a lot.

How much?

The truth is that it is impossible to know. But those of us who are aware, that we follow these kinds of values, will have a better chance of climbing the wave, perhaps a giant wave, a tsunami of profitability.

Or maybe not. But let’s be careful ..